The new Gardendale property tax: How much will you pay? Who’s affected?

Published 3:24 pm Wednesday, September 18, 2013

The Gardendale City Council’s announcement earlier this month about property taxes has raised numerous questions for residents who will be affected.

The city council on Monday passed a new 5-mill ad valorem, or property tax.

The taxes will come due in October 2014.

In addition, the city council will hold a special election on Nov. 12, where Gardendale voters will either approve or turn down an additional 5 mills added to their property taxes.

Five mills is the most a city can levy for property tax without a referendum, or a vote by the people.

The purpose of the increased property taxes is to help fund a Gardendale school system. The city commissioned a feasibility study this spring to determine whether the city could support its own school system if city leaders decide to separate from the Jefferson County School System.

Dr. Ira W. Harvey of Decision Resources LLC, who performed the study, determined that it is financially feasible for Gardendale to support its own school system.

He said whether the city needs to collect municipal property taxes would depend on what kind of school system the city and the citizens want.

Currently, the city of Gardendale does not levy property taxes on its citizens. However, that does not mean Gardendale homeowners do not pay property taxes.

Currently, homeowners who are not exempt pay 50.1 mills in property taxes every year. Of that amount, 30.1 mills goes to the Jefferson County Board of Education and 20 mills goes to the Jefferson County government.

If Gardendale forms its own school system and pulls out from the Jefferson County system, the 30.1 mills of property tax that Gardendale citizens currently pay would be allocated to the Gardendale city school system rather than the county school system.

“You inherit a substantial tax base from the beginning,” Harvey told the audience in May when he announced the results of his feasibility study.

However, city leaders say the school system would still need the additional 10 mills in order to have enough operating revenue.

Why does Gardendale need the revenue?

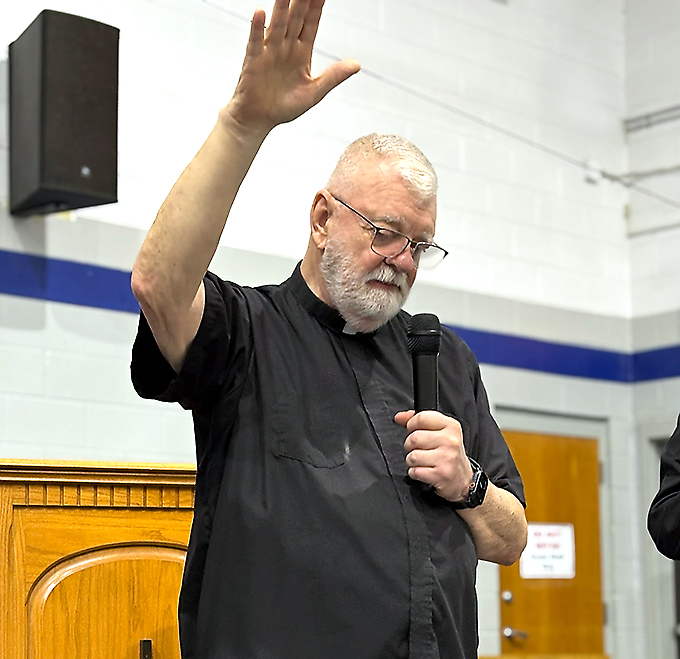

“If we’re going to proceed with the school system, we have to have the 10 mills,” said City Council President Stan Hogeland at the Sept. 3 meeting.

Mayor Othell Phillips said the city knows it needs the extra tax money because of the results of a study by Carr, Riggs and Ingram, an auditing firm that does the budgets and auditing for several school boards across the state.

“We hired them to come in and give figures on what they projected any extra costs to be in order to adequately fund the system and have enough operating costs,” Phillips said.

The city will host two town hall meetings for citizens before the Nov. 12 special election, he added. The date of the meeting will be announced.

Present at the meeting will be representatives of firms the city has hired to conduct feasibility studies, budget studies and an economic impact study.

“All of the parties that have done the due diligence studies will be at the town hall meeting. We’ve done our homework and we’re trying to compile it,” Phillips said. “The council and I are 100 percent behind the school system. We’re convinced it’s the best thing for Gardendale students and for the community.”

How is property tax figured?

The Jefferson County Board of Equalization determines market value; market value might be different from the property appraisal value.

A mill is a tenth of a cent, and equals $1 for every $1,000 of market value. For example, 10 mills is 0.01, or one cent.

To figure out how much extra money Gardendale residents will pay with the new property tax, say the market value of a house is $100,000, and the city wants to levy 10 mills.

The formula for figuring millage tax is simple: Take 10 percent of the market value and multiply that by the millage rate.

Ten percent of $100,000 (market value) is $10,000. $10,000 times 0.01 (10 mills) equals $100.

So, a 10-mill property tax on a $100,000 house is $100 a year.

The example that Mayor Phillips gave in an open letter to the public stated that the average house in Gardendale is worth about $144,000. A 10-mill property tax would equal a yearly increase of $144, or 39 cents a day.

“I think that is a worthy investment,” Phillips said in the letter.

Owners of commercial property will pay a slightly higher rate: It is taxed at 20 percent of market value multiplied by the millage rate. Commercial property with a market value of $100,000 would owe $200 a year with a 10-mill tax.

What happens if voters turn down the 5 mills?

The 5 mills of property tax that the city imposed this week is earmarked for education. It can not be used for anything else.

If the second 5 mills of property tax fails a vote, and the city decides not to form a Gardendale school system because of it, the city has a couple of choices about what to do with the revenue that will still be generated from the 5 mills passed this week.

Hogeland said the city can let the funds accumulate in hopes that voters will later pass the extra property tax. Another option is to repeal the property tax levied this week.

City leaders have said the Gardendale school system can not happen without the 10-mill property tax.

Who is exempt?

Some citizens are exempt from paying property taxes.

Taxpayers who are age 65 will have to pay property taxes if they have a job and earn more than $12,000 a year in federal taxable income.

However, seniors age 65 and older are exempt from paying property taxes if they earn $12,000 or less, even if they receive Social Security, a pension, retirement or other such benefits.

Also, people who are disabled are eligible to apply for an exemption.

“If citizens are currently not paying property tax, and their circumstances do not change, they’re still exempt,” said Phillips.