Local News

City revenues stay ahead of surging costs as fiscal year enters final quarter

Make a little money; spend a lot more: That’s the pattern that’s emerged in this year’s periodic financial ... Read more

Make a little money; spend a lot more: That’s the pattern that’s emerged in this year’s periodic financial ... Read more

HANCEVILLE — Surging fuel costs and other inflationary pressures have compelled city leaders at Hanceville to revisit the ... Read more

HANCEVILLE — Hanceville city leaders are approaching the coming fiscal year with a conservative caution, unsure of whether ... Read more

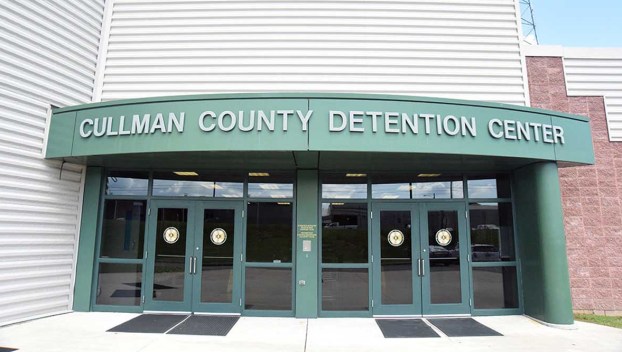

Cullman County will operate a slate of budgeted expenses for the coming fiscal year that rings in ... Read more

Federal Judge Madeline Haikala on Monday entered an order that will require the City of Gardendale to pay ... Read more

Sara Franco Tapia remains in the hospital according to a statement from Cullman County Sheriff Matt Gentry. Due ... Read more

Parkside School is facilitating donations to help with funeral expenses for two brothers, ages 9 and 3, who were killed ... Read more

WASHINGTON — The proportion of Americans without health insurance edged up in 2018 — the first evidence from ... Read more

WASHINGTON — Single Americans make up more than half of the adult population for the first time since ... Read more

Here’s what’s going on this Tuesday, February 7… Commission president disputes sewer proceeds. Jefferson County Commission President David ... Read more