Community

In our area

Email community happenings to editorial@cullmantimes.com At the Foot of the Cross Church events At The Foot Of The ... Read more

Email community happenings to editorial@cullmantimes.com At the Foot of the Cross Church events At The Foot Of The ... Read more

After experiencing a dramatic turnaround in her health by treating multiple issues and medical conditions with medical cannabis ... Read more

Longtime former Cullman County Museum curator Drew Green is among a handful of statewide honorees to be recognized ... Read more

Officials from both Cullman City and Cullman County have taken the first steps to revitalize the Cullman County ... Read more

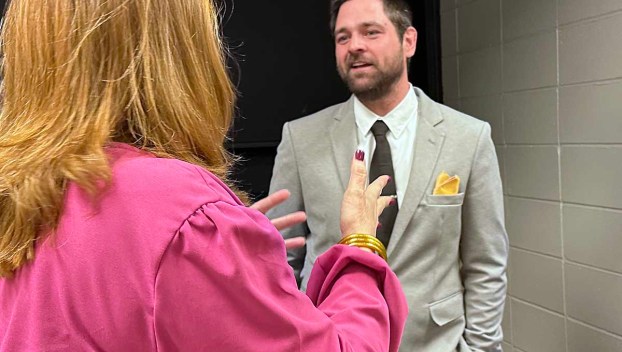

Cullman has hired Danny Stiff as its new head football coach. The move officially met with unanimous approval ... Read more

HANCEVILLE — Good Hope’s varsity girls took down Clements, Good Hope’s varsity boys outlasted Decatur, and Cullman’s varsity ... Read more

In a crackling atmosphere befitting a heavyweight matchup, Cullman’s varsity boys emerged from Friday night’s hardcourt slugfest against ... Read more

The Times is counting down its top stories of 2022. Here’s No. 4: The semi-monthly public proceedings of ... Read more

The North Alabama Agriplex received a big financial boost to its plans for expansion on Friday, the same ... Read more

Holly Pond’s boys (Class 2A), Cold Springs’ girls (Class 2A) and Good Hope’s girls (Class 4A) debuted at ... Read more