Voters to decide on local 15% tax on medicinal cannabis

Published 12:00 am Friday, May 26, 2023

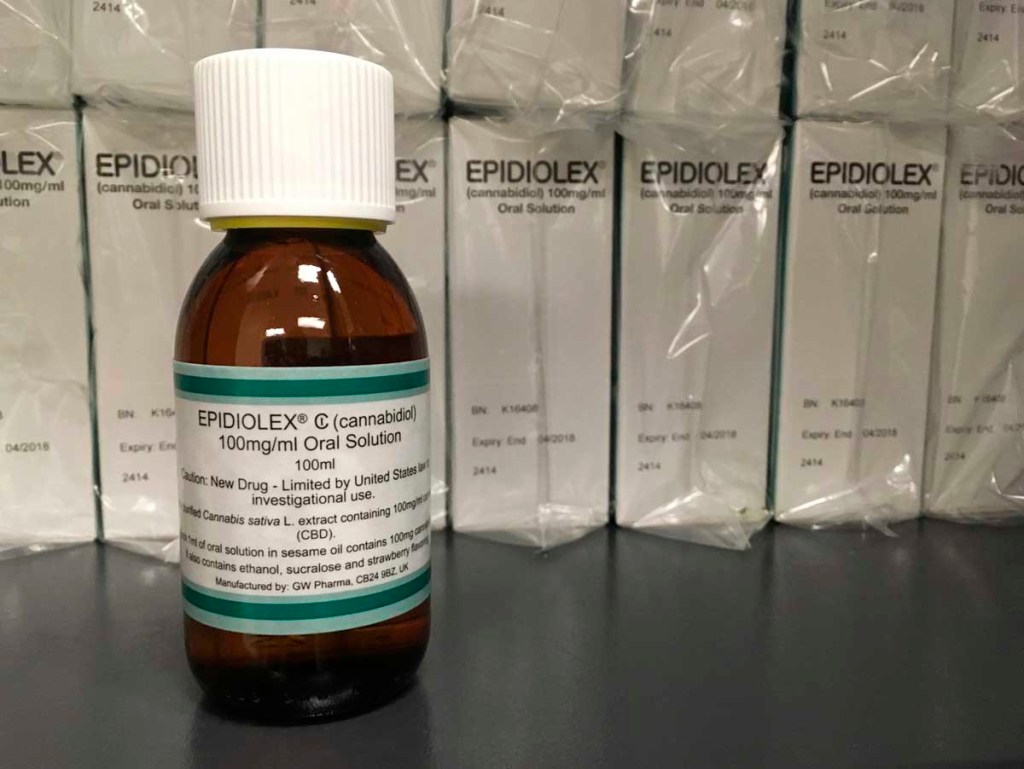

- This May 23, 2017 file photo shows GW Pharmaceuticals’ Epidiolex, a medicine made from the marijuana plant but without THC. U.S. health regulators on Monday, June 25, 2018, approved the first prescription drug made from marijuana.

Local voters are likely to decide whether to institute a 15 percent tax on any medicinal cannabis sold in Cullman County, after the Alabama Senate on Wednesday approved a local referendum bill that already had cleared the Alabama House. With the 2023 legislative session winding down to its final few days, the approved measure now awaits Gov. Kay Ivey’s signature.

The bill (HB 469) doesn’t directly institute a tax on locally sold medical cannabis. Rather, it clears the way for that question to be included on ballots that Cullman County voters will see in an upcoming election — likely during the 2024 cycle. Alabama House Rep. Corey Harbison (R-Good Hope), who sponsored the bill alongside Reps. Randall Shedd (R-Fairview) and Tim Wadsworth (R-Arley), said Thursday that no other statewide voters will decide the issue: The referendum question will only appear on ballots used by voters in Cullman County. The Cullman County Probate Office will set the referendum question for a forthcoming election.

Trending

If voters approve the referendum, Cullman County medicinal cannabis sales would be subject to a 15 percent tax; one that’s applied only to local sales and whose revenues would be split between the Cullman District Attorney’s Office (at 66.7 percent) and the local legislative delegation (at 33.3 percent), with the delegation required by law to apportion its share of the revenue for local mental health initiatives.

Though Alabama allows for sales taxes on over-the-counter medications, all prescription drugs, including palliative drugs such as opioids, are exempt from sales tax statewide. If voters approve the local bill, however, medicinal cannabis uniquely would be subject to a 15 percent tax in Cullman County.

Asked Thursday whether legislators had concerns over taxing a single category of palliative prescription drug to the exclusion of all others, Harbison said that state lawmakers are entering uncharted regulatory territory as more U.S. states decriminalize marijuana and its derivatives, whether for medicinal purposes, recreational, or both.

“There are federal guidelines that regulate what states can do on legal prescription medications, but when it comes to cannabis, there are no guidelines,” he said, noting that the federal Controlled Substances Act of 1970 continues to regard cannabis as a Schedule I controlled substance illegal for sale to, or consumption by, individual consumers. “Prescription medications are FDA-approved and DEA-approved, but cannabis is technically illegal at the federal level.

“This is a category of drug that covers a broad range of patients who have a broad range of symptoms that would lead them to seek a medicinal cannabis prescription,” he added. “And even though Alabama does not directly tax other types of prescription drugs, pharmacies and other providers of those type of drugs must cover their costs under a separate tax — the pharmaceutical provider tax. State law says that they cannot pass that tax on to their customers, but they must compensate for it in some shape or form, and that typically comes across in the cost of the medications themselves.”

Gudger was on the Senate floor when contacted by phone Thursday, but followed up with a statement to The Times. “The people’s voice is stronger than the legislature’s, and anytime we can put a constitutional amendment before voters to let them decide directly, it’s better for the people. That’s what this bill does: It brings the issue to them.”

Trending

Attempts to reach Shedd Thursday were unsuccessful.

On June 12, the newly formed Alabama Medical Cannabis Commission (AMCC) will award its first round of statewide medicinal cannabis licenses, clearing the path for licensed growers, processors, distributors, and dispensaries statewide to begin fulfilling their sanctioned roles in the medicinal cannabis supply chain. Cullman County’s Wagon Trail Hemp Farms is among 38 Alabama applicants seeking one of only five AMCC licenses that will be awarded to integrated facilities statewide — businesses which will be permitted to carry out all supply chain activities, from cultivation to dispensary sales.