Alabama lawmakers approve pandemic-related tax exemption

Published 9:05 am Friday, February 18, 2022

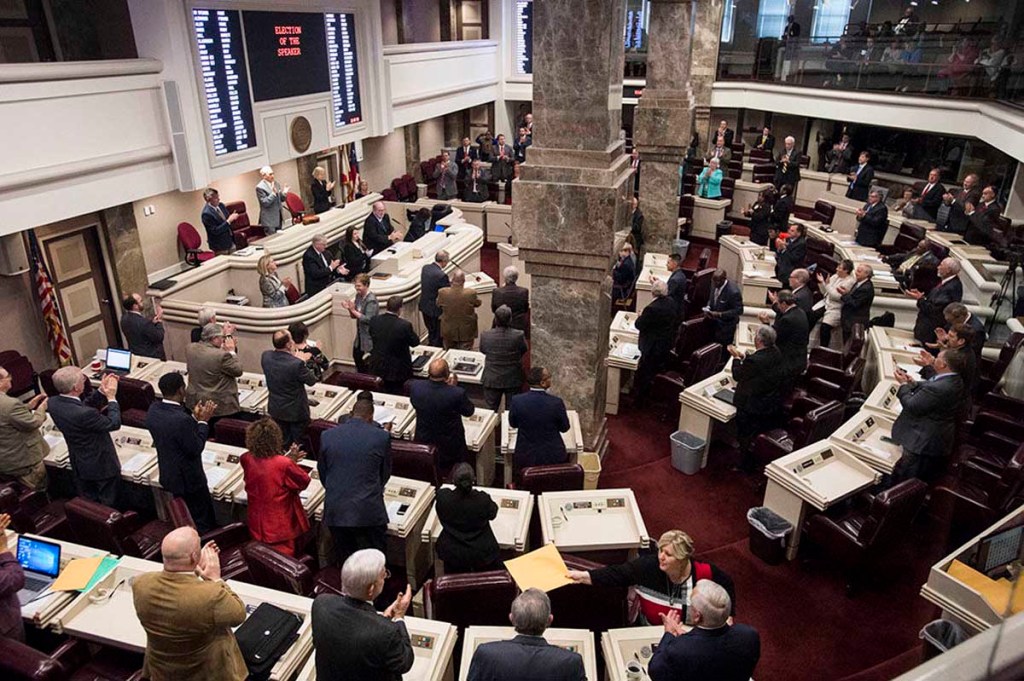

- This Jan. 8, 2019, photo shows the Alabama House of Representatives convening during the 2019 Alabama Legislature organizational session at the Alabama State House in Montgomery, Ala.

MONTGOMERY, Ala. — Alabama lawmakers on Thursday approved legislation so families won’t have to pay state income tax on the monthly child tax credit payments they received under the federal pandemic relief package.

The Alabama Senate and Alabama House of Representatives on Thursday approved identical versions of the bill. The measure now goes to Alabama Gov. Kay Ivey. The bills passed without a dissenting vote.

Republican Rep. Jim Carns said Alabama, unlike many other states, did not have an automatic adjustment in its tax code that excluded the federal benefit from the calculation of taxable income.

“Every state in the nation except Alabama and Louisiana had automatic systems in their revenue department to make this tax-free. Without us doing a statute, it would not be tax-free. So, this is fulfilling the intent of the (American Rescue Plan) funds that were sent to working families who had children at home,” said Carns, the sponsor of the bill in the Alabama House of Representatives.

The American Rescue Plan Act increased the federal child tax credit that families can claim each year, and eligible families received six monthly deposits as a partial advance on the credit. Eligible families received $300 monthly for each child under 6 and $250 per child older than that.

The approved legislation means the additional tax credits will not count against the federal deduction people use to lower their state income tax.

“It was roughly $250 per month per child that was received by families. So now as they file their tax returns, they will be in a position to get a credit to exempt that from income,” Republican Sen. Dan Roberts said.

Roberts, who sponsored the Senate version of the bill, estimated that the change would save families with two children about $200.

People who have already filed their state income tax forms will have to file an amended return to claim their full federal deduction, Carns said.

“Most folks have not filed yet” Carns said. “Those few that have filed are going to have to come back and do a corrected tax filing.”