Alabama House clears Cullman County bill letting voters decide tax on medicinal cannabis tax

Published 3:15 am Saturday, May 20, 2023

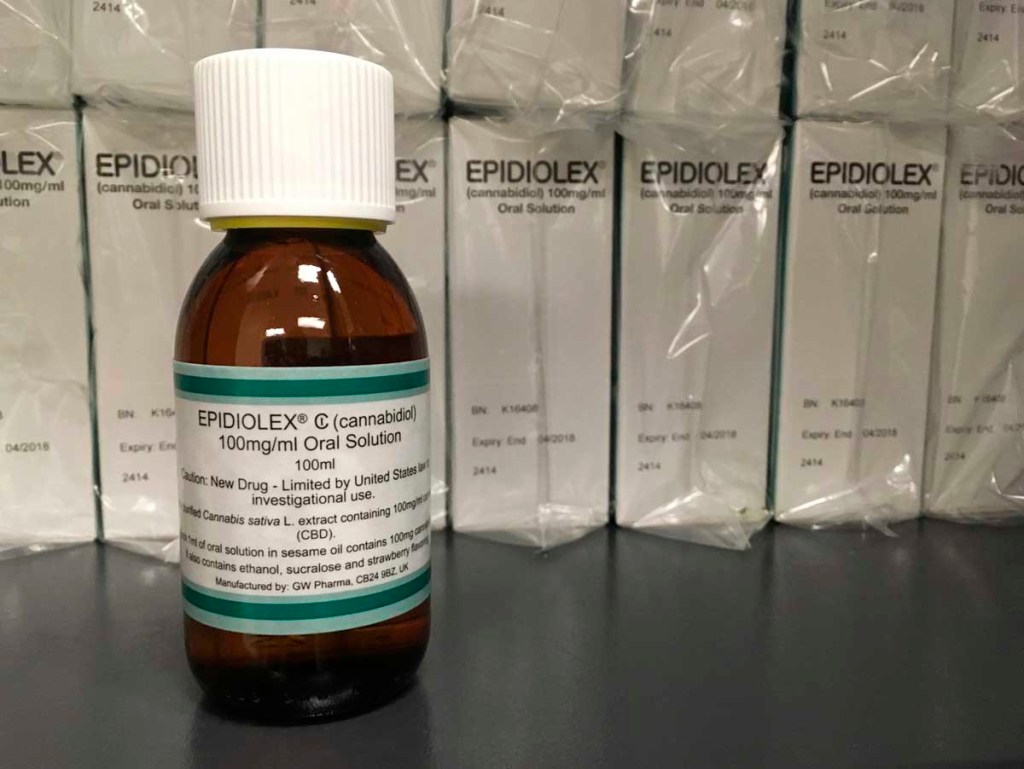

- This May 23, 2017 file photo shows GW Pharmaceuticals’ Epidiolex, a medicine made from the marijuana plant but without THC. U.S. health regulators on Monday, June 25, 2018, approved the first prescription drug made from marijuana.

A local bill progressing through the Alabama legislature could secure a new funding stream for both area mental health initiatives and the Cullman County District Attorney’s Office — if, that is, local voters approve the measure in a future referendum.

The bill, which would institute a ballot measure tasking voters to choose whether to establish a 15 percent tax on medical cannabis sold in Cullman County, already has cleared the Alabama House of Representatives and is expected to come before the Senate next week.

Trending

Sponsored by members of Cullman County’s legislative delegation including Alabama House Reps. Corey Harbison (R-Good Hope), Randall Shedd (R-Fairview), and Tim Wadsworth (R-Arley), HB 469 floats a ballot measure which, if approved, would amend the state constitution to institute a 15 percent tax on future local medical cannabis sales, in addition to local sales taxes already in place on retail goods.

If approved, revenues from the tax would be divided between the DA’s office (at 66.7 percent) and the local legislative delegation (at 33.3 percent), with the provision that the delegation’s 33.3 percent portion must be used on local mental health initiatives of their choosing. Harbison noted that a medicinal cannabis tax could compensate for the recent downturn in worthless check revenues that the DA’s office historically has relied upon to fund staffing and other enforcement measures.

“The DA had been seeking ways to possibly get additional funding for his office to help hire more staff,” explained Harbison. “At one point, they got a lot from the worthless check unit, but that really isn’t producing much at all, at this point. We agreed as a delegation to let citizens vote for a tax on it, and it is earmarked for the DA’s office and for mental health. It’s pretty cut and dried. The citizens can decide if they want it or not, and our delegation is good with whatever voters decide.”

The measure’s timing in the current legislative session roughly coincides with the expected June 12 awarding of an initial round of licenses to medical cannabis growers, processors, distributors, and dispensaries by the Alabama Medical Cannabis Commission (AMCC), the state panel set in charge of reviewing applicants and awarding licenses to business participants involved in every aspect of the medicinal cannabis supply chain.

Cullman County’s Wagon Trail Hemp Farms is one of 38 applicants statewide to have applied for one of five AMCC licenses to be awarded next month to integrated facilities in Alabama, a designation that allows a business to participate (and submit to state regulation) across all phases of the supply chain, from cannabis cultivation to final sale of refined end products at a dispensary.

Harbison said a voter referendum on the tax measure, if approved, would likely come in the 2024 election cycle, though the bill does not specify a date. “If it’s approved, it will not come in a special election,” he said. “It will coincide with an election that’s already scheduled, and it won’t cost taxpayers any additional money.”

Trending

This story has been updated to clarify revenues from the tax will fund additional personnel in the DA’s office.