Need to know: Sales tax vote Tuesday

Published 5:30 am Saturday, February 29, 2020

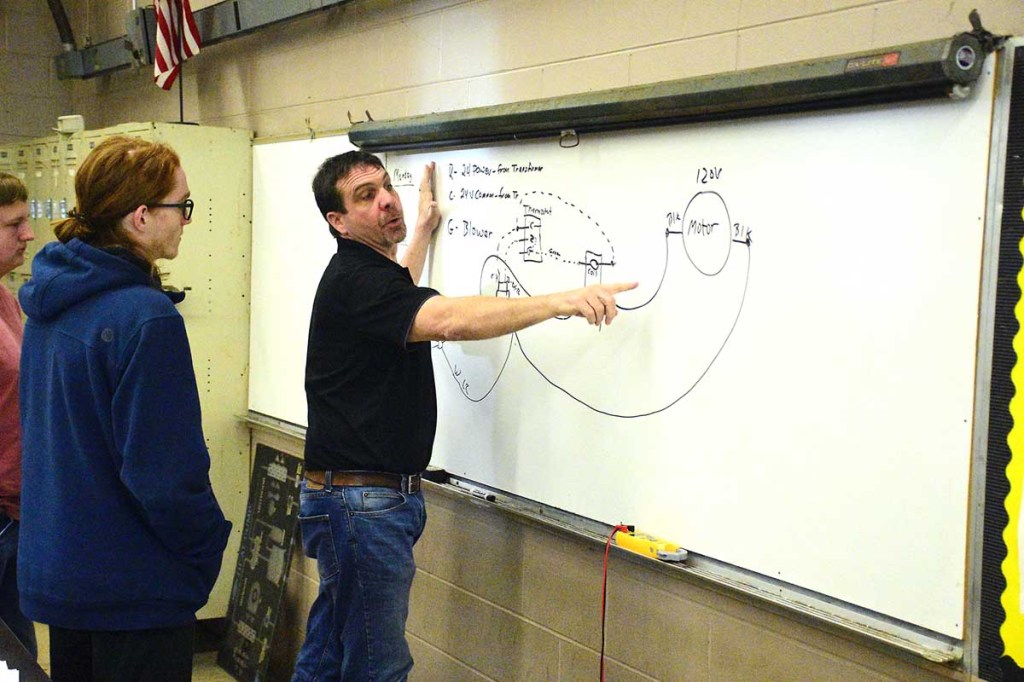

- Career Center

Tuesday’s primary election will feature a local tax referendum that would raise the county’s sales tax rate by one cent to improve local schools. Here are some of the things you need to know before you make your final decision on Tuesday.

How much money will it generate?

The tax is projected to bring in around $10 million per year, and that amount will be split between the Cullman City and Cullman County School Systems, with the city system receiving around 23 percent and the county system getting the remaining 77 percent.

What happens if the referendum passes?

Any revenue from the sales tax would go towards school facilities and safety improvements, including upgrades or new buildings on every campus and a new Cullman Area Technology Academy.

During recent community meetings to garner support for the tax, Cullman County Schools Superintendent Shane Barnette has shared some of the projects and building renderings that would be possible with the tax, but a 10-year strategic plan for the revenue will be voted on by the members of the school board after the tax’s passage.

He said all of the tax revenue would go into a separate fund that would only be used for the facility and safety upgrades, and the system will publish a report every month that shows where the money is being spent.

“If anybody ever questions, ‘I want to know where my money’s going,’ they can pull that up online or come by the Central Office to get a paper copy and see exactly what’s been spent out of that fund,” he said.

What happens if the referendum fails?

The one-cent sales tax referendum would see around $7.7 million going to the school system to be used for facility and safety upgrades, but there is no plan for how the system would fund repairs and maintenance needed at the county’s 29 facilities if it fails.

Barnette said some of the school buildings that are in use today are 100 years old, and some of the issues around the county have included burst pipes, ruined floors, mold and parts of schools so badly deteriorated students have been moved into mobile units.

Barnette said the system’s small maintenance staff has done excellent work to make sure schools are kept up, but the age of the facilities are beginning to catch up with them.

“They’re bandaging, they’re keeping things afloat as best they can,” he said. “But some of these buildings that are 100 years old, they’re gradually catching up to us. I’m afraid of where we’re going to be at in a couple of years.”

Barnette said plans like school consolidation or removing bus routes are not yet on the table for the board, but no increase in funding would mean future board members or superintendents could have tough choices to make.

“It probably won’t be this superintendent, but there will be some tough decisions that have to be made,” he said. “Because there’s no way with our current funding that we can keep our schools updated like we have right now.”

Does the city school system support the tax?

While the Cullman City School System would see around 23 percent of the revenue generated by the tax increase, the Cullman City School Board has not come out in support or opposition of the referendum.

“The Cullman City Board of Education has not established a formal position in regards to the proposed sales tax and its impact on revenue for our system,” Cullman City Schools Superintendent Susan Patterson said in a email.

Why doesn’t the county school board sell its property on Smith Lake?

The county school system owns 435 acres of property on Smith Lake featuring an unfinished house and 25,000 feet of shoreline, and many people have called for the system to sell the land instead of trying to raise money through a tax increase, but the idea behind the system’s control of the land was that it was meant to be used as a long-term source of revenue for schools, Barnette said.

Most of the property came from the state’s hands through Section 16 of the Alabama Code in 2012, but the board voted in 2015 to purchase a 10-acre plot of land at a price of $1.2 million to provide access to the Section 16 property.

As part of the original plan to take ownership of the property, the board adopted a plan for 90 percent of the eventual revenue from development or sale of the land to be deposited into a trust account, with the remaining 10 percent deposited into the school system’s general fund. Interest payments from the trust fund would be distributed annually based on the number of students residing within the boundaries of the Cullman City and County School Systems.

Because 90 percent of the money from a potential sale is already committed to go into a trust fund, the short-term gain for the board would be too small to make a big impact on school facilities, Barnette said.

Assuming the land was sold for $4 million, that would leave around $400,000 that would be available to go into the general fund, but that $400,000 would also have to be split with the Cullman City School System, leaving around $308,000 for immediate use by the county system, he said.

“Unfortunately that does not go very far,” he said. “$300,000 probably wouldn’t even add one classroom to one school.”

Who is paying for the “Vote Yes” campaign?

While employees from the Cullman County School System have joined in the campaign to encourage residents to vote in favor of the tax, the funding for the signs and website to support the campaign is coming from a political action committee that was formed earlier this year.

The PAC, called Advocates for Excellence in Education, was registered with the Alabama Secretary of State on Jan. 18 and lists former Cullman County School Board member Wendy Crider as its chairwoman. Further information about the PAC, including its weekly and monthly financial reports, can be found by visiting fcpa.alabamavotes.gov.