(Update) Many customers paying rescinded half-cent sales tax

Published 5:34 pm Tuesday, May 7, 2019

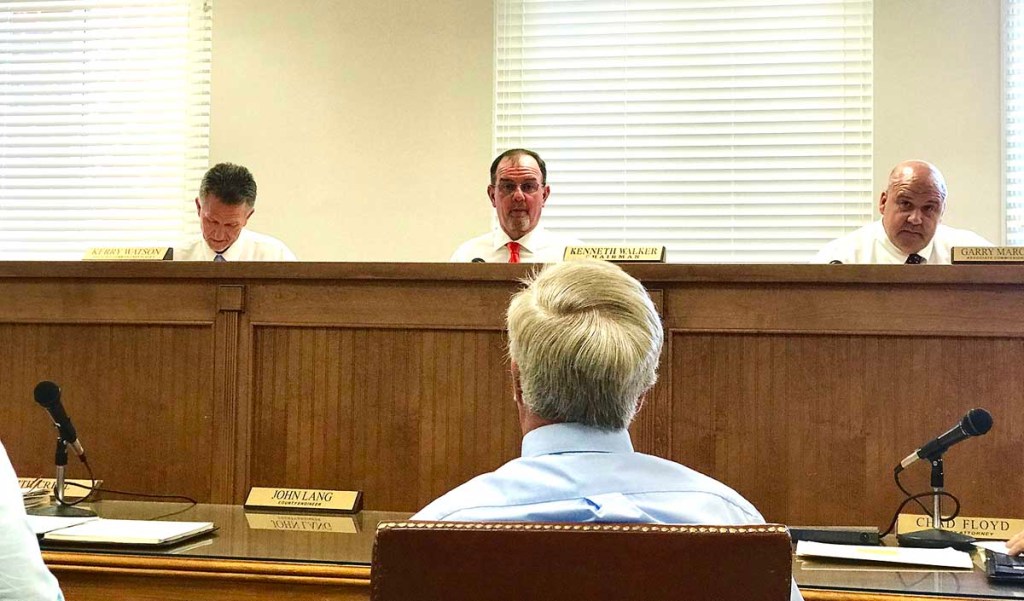

- Cullman County Commission

The Cullman County Commission’s approval of a half-cent sales tax in March set in motion a process that has many businesses collecting the money, even though it was rescinded more than a month later.

Once the tax was approved, the Cullman County Sales Tax/Revenue Enforcement Department went to work preparing notices to 5,300 businesses that the half-cent tax would go into effect May 1. To comply with the tax, which was initially approved for local education, businesses had re-set their registers or business systems to automatically add the tax on purchases.

Trending

But the commission turned around on April 23 and rescinded the tax, leaving little or no time for businesses to adjust back to the former rate, said Chris King, director of the county sales tax/revenue department.

“Now we have had to turn around and send another 5,300 letters to those same businesses that the tax is not in effect,” King said. “The problem is that a lot of these businesses have corporate offices that are located elsewhere. They are having to go through that process again. We can’t just run around to everyone and tell them it was rescinded.”

While there were still reports of the tax being charged Tuesday, Cullman Mayor Woody Jacobs’ assistant, Leanne West, posted on Facebook that Walmart has fixed the tax rate in its stores and was giving refunds to any customers who requested it.

King said the Alabama Department of Revenue also requires a 60-day notice of a new tax, or a rescinded tax. He said the state department’s website at this time reflects the half-cent sales tax increase.

The question of what will become of the money also remains unanswered.

“We don’t know exactly what will do now,” King said. “The priority has been to get the notices out that the tax is rescinded, and we’ve moved quickly with that.”

Trending

The notices stating that the half-cent tax was rescinded started going to businesses on April 30.

“We couldn’t just run around and tell everyone because so many of the larger retailers and restaurants are based out of the area,” King said.

Commission Chairman Kenneth Walker said a discussion will come on what to do about money that was collected during the errant time.

“I know the commissioners will have to talk and we will need to talk to the county attorney, as well,” Walker said. “It happened so quickly that the notices are probably still getting to some people. It will be interesting to see what was collected in just a short time.”

The half-cent tax was enacted without public discussion. A week after commissioners approved it, at the urging of Cullman County Schools officials, Superintendent Shane Barnette unveiled plans for a $30 million sports complex that he said would generate additional money for county schools.

After objections to the plan, the project was shelved and school officials were beginning to move forward with improvements at local schools, which was a large part of the reason for the tax.

Those plans have been on hold since the tax was rescinded. The school board and superintendent have the option of putting the tax up for a public vote in the March 2020 elections.

The tax was expected to generate about $4 million per year for county schools over a 15-year period, and another $1 million or more for Cullman City Schools.

David Palmer may be contacted at 256-734-2131, ext. 116.