College: The Real Cost

Published 2:30 pm Wednesday, September 7, 2016

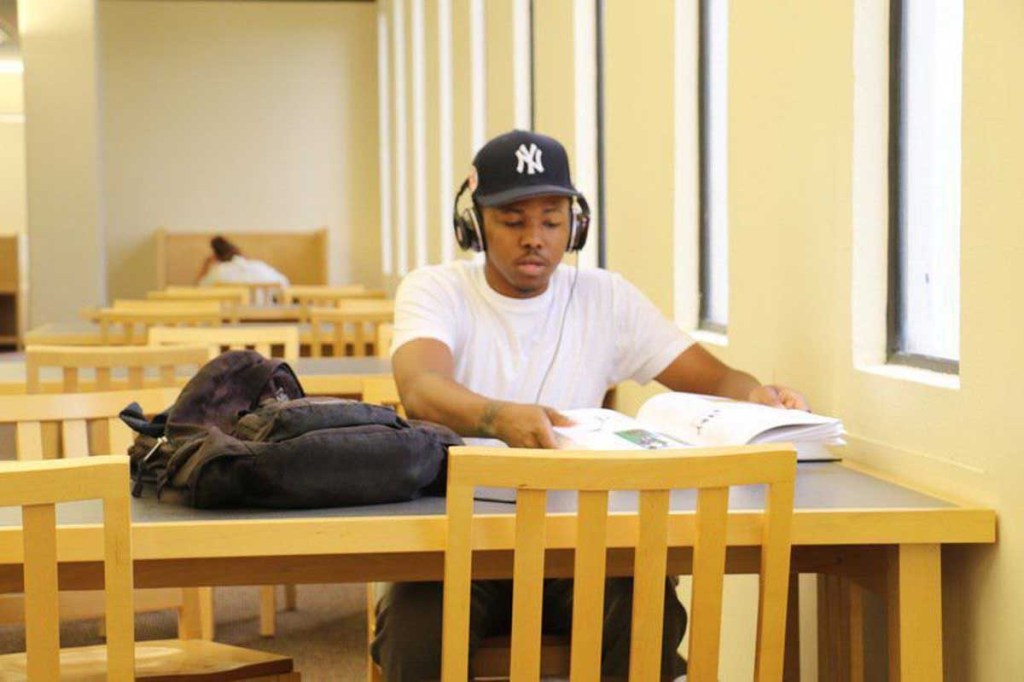

- Malcome Meyers originally planned on going into the Air Force until family persuaded him to attend college.

VALDOSTA, Ga. — College.

The institution of higher learning. Where lifelong friends and memories are made, lessons are learned and skills developed. The good times of college are a given.

What about the actual cost of obtaining that degree?

What about the return on investment after receiving that degree?

Malcome Meyers had no intentions of going to college. A New York native, he intended on joining the Air Force after high school. His family wanted other things. After pressure from an aunt, he applied late to colleges and was accepted at Georgia’s Valdosta State University.

For many students, college means finding assistance to pay for the rising costs of higher education. Meyers is no exception.

According to the National Center for Education Statistics, annual current dollar prices for undergraduate tuition, fees, room, and board were estimated to be $15,640 at public institutions like VSU, $40,614 at private nonprofit institutions, and $23,135 at private for-profit institutions for the 2013–14 academic year.

Since then, students nationwide have paid even more in hopes of attaining a degree that will benefit them more than hinder them.

The estimated cost of attendance for an in-state, freshmen student at Valdosta State University, according to its cost calculator, is $7,627 for an incoming student. The amount includes a meal plan as well as housing. After the initial year of the required living on campus and meal plan, a student can be more than $15,000 in debt.

This is the reality of the cost of attending college.

Meyers’ major is mass media and he hopes to one day work in the media industry, but for now, he works as a server at a local restaurant.

“Most people I know don’t have financial aid for the whole thing (college); I am doing the whole thing with loans,” Meyers said.

He said he doesn’t know exactly what he will do after college.

“I just don’t want to end up struggling, living paycheck to paycheck,” he said. “When I got here, I didn’t know what I wanted to do. I switched majors three or four times.”

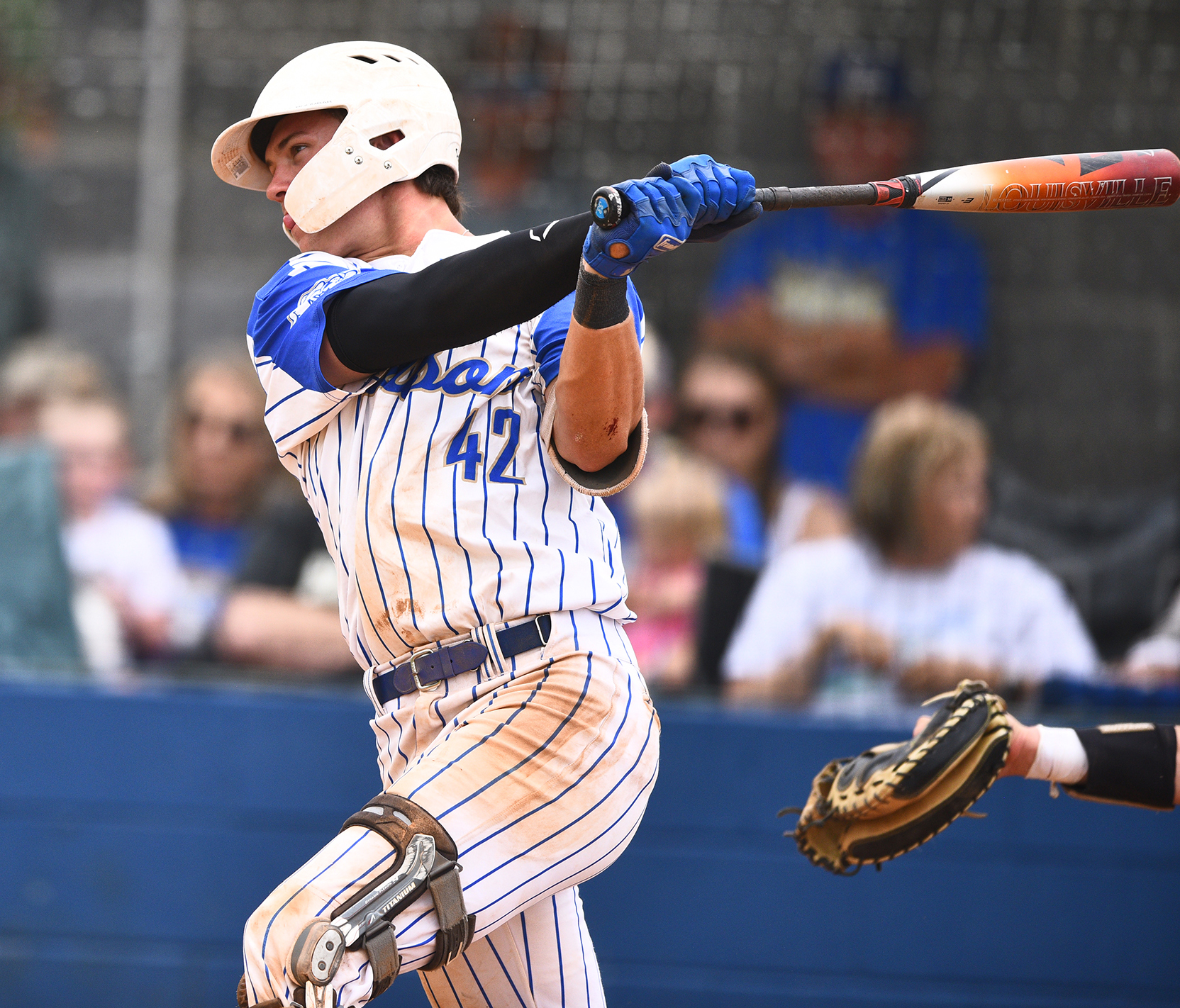

Garett Crook is biology major at the same south Georgia university. Like Meyers, he is relying on student loans and other financial aid to pay for his college. He too works at a local restaurant as a cook.

He hopes to become a biology teacher for high school students when he graduates. Crook is less worried about finding a job as a teacher, but he is not convinced he will find the specific job he wants after graduation.

Discussing students who did not intend on going to college but societal pressures forced them, he said, “More and more students are in this situation. People who normally would not have thought about college are suddenly thinking it is their only option.”

More people are choosing college because they think it is the only way to get a job, he said. With the saturation of the market having so many college graduates, there is a shortage of jobs that require the skills learned in college.

Despite the focus on college enrollment as a means to a profitable end, data in recent year shows that a number of college grads still face underemployment after graduation.

A 2014 Pew Research article cites that, in 2012, about 44% of grads were working in jobs that didn’t require a college degree. About one-in-five (23%) underemployed recent grads were working part-time in 2011, up from 15% in 2000.

Crook said he thinks more people should look into going to technical schools. The cost of tuition is lower and the jobs you qualify for can come with higher pay.

Meyers and Crook agreed college is not for everyone.

“I think anyone should have the opportunity to go, but I do not think everyone should go,” Meyers said.

Both agreed there should be a change in the school systems to present children and high school students with other options.

“Just look at some of the greats that didn’t go to college,” Meyers said.

The lifelong rationale that has been taught and ingrained in students is if you do not go to college after high school, you will not be as successful in life.

However, as any economics student knows, the importance of supply and demand can be observed even with college degrees.

“In fall 2016, some 20.5 million students are expected to attend American colleges and universities, constituting an increase of about 5.2 million since fall 2000,” according to the NCES.

More and more students are obtaining degrees, but are there enough jobs to go to these more highly educated workers?

While unemployment rates are decreasing, according to the Bureau of Labor Statistics, the underemployment rates are at almost 14 percent. Underemployment occurs when skilled workers settle for jobs they are over-qualified for. For example, a college graduate taking a job as a server in a restaurant.

When entering college, students are expecting to leave school and find a job simply because they have a degree; many graduates have learned this is not the case.

The question remains: Is college worth it?

The return on investment for going to college is falling, according to a Goldman Sachs study published in December 2015. With the rising rate of college tuition, student loans are taking longer and longer to pay off, even if a graduate finds a job right out of college.

In 2010, average students took eight years to pay off their college debt, according to reports. The 2015 graduates are not expected to pay off their loans until the age of 31, and in the future, Goldman Sachs predicts graduates will not pay back their debts until the age of 37.

There are options to help pay for school such as scholarships and grants so the amount of money actually paid can be significantly less.

High school graduates have other options to continue their educations without obtaining a four-year degree. Technical colleges and trade schools are viable options that often provide well-paying jobs right out of school.

However, a CNN Money report by Tami Luhby, published June 30, 2016, cited a study by the Center on Education and the Workforce at Georgetown University that stated of the 11.6 million jobs created after the Great Recession, 8.4 million went to those with at least a bachelor’s degree and another 3 million went to those with associate’s degrees or some college education.

Traditional universities are also exploring educational options, alternative degree programs and helping students obtain industry-standard certifications to address the shifting dynamics.

Praats writes for the Valdosta, Georgia Daily Times.